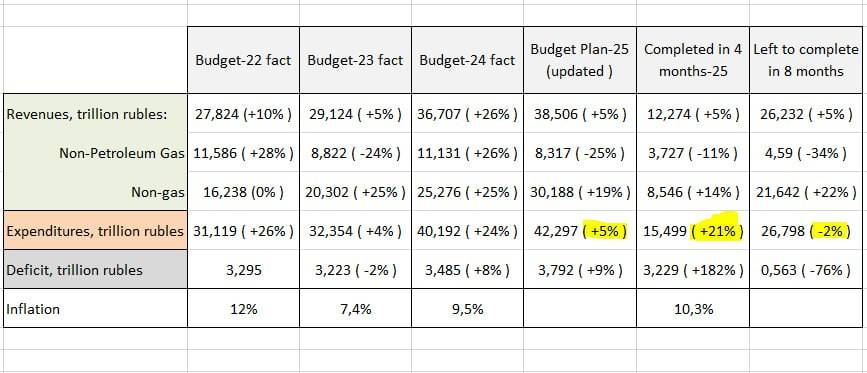

I looked at Russia’s 2025 budget figures, and what I found is nothing short of a disaster in the making. The numbers I compiled in the table reveal the harsh reality: Russia is on the brink of financial collapse due to its reckless military spending and collapsing revenue base. Let’s break it down.

The 2025 budget plan was for a 5% increase in spending, a total of 42,297 billion rubles. But in the first four months alone, they’ve already spent 15,499 billion rubles — an increase of 21%. To meet their plan, they’ll need to cut spending by 2% in the remaining months, bringing it to 26,798 billion rubles. This is fantastic, as long as they’re pouring money into the war. Revenues are on track, up 5%. But oil and gas revenues, their economic lifeline, fell 11% to RUB 3,727 billion. Non-oil revenues are also falling. They were growing by 25% each year in 2023 and 2024, with a 19% growth target for 2025, but in fact, growth has fallen to 14% over the past four months, indicating deeper problems in the Russian economy.

Because of this overspending, the budget deficit has grown by 182% year-on-year to RUB 3,229 billion over four months. To reach their annual target, they will need to cut the deficit by 76% over the remaining eight months – an impossible task in wartime.

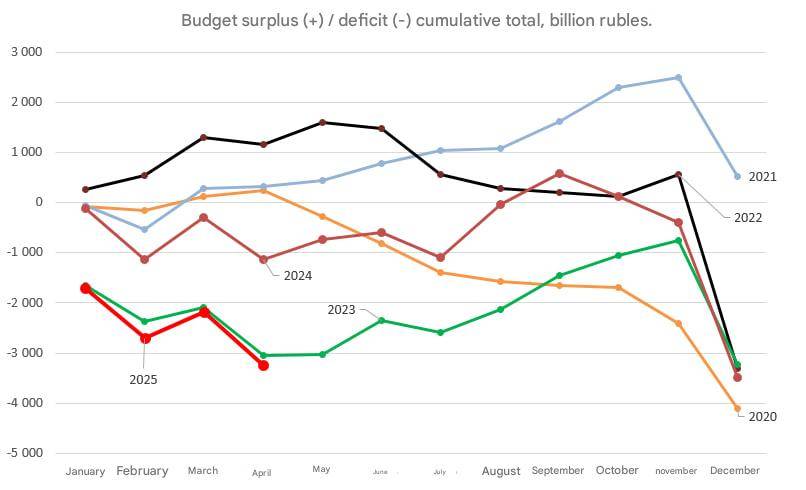

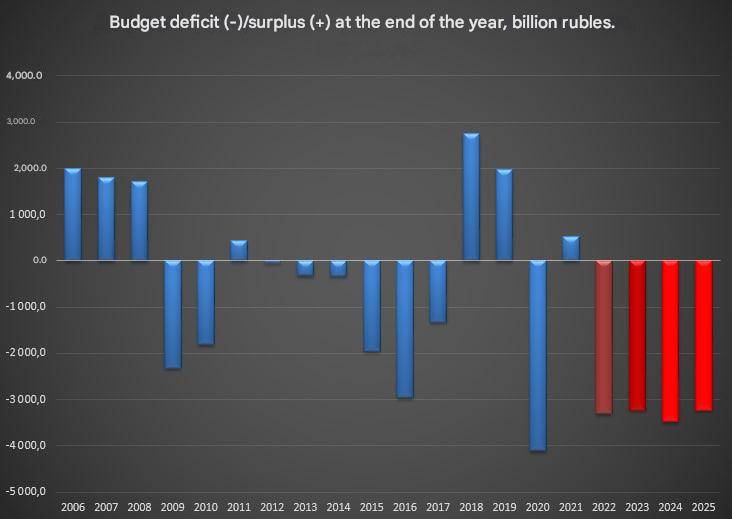

I have been tracking their deficit for years: in 2024 it was 3,485 billion rubles, but in 2025 it could grow to 5, 6 or even 9 trillion rubles. We have not seen such a deficit since 2020, when the deficit was 4.1 trillion rubles during the pandemic.

Explanation of the chart. Revenues for 2025 on the chart are based on the fact for 4 months

War is the heart of this crisis. Military spending is growing rapidly – the Center for European Policy Analysis estimates that it will amount to $ 140 billion in 2025, which is 25% more than expected. Meanwhile, the National Welfare Fund, their financial buffer, is almost depleted to 3.2 trillion rubles as of April 1, and the data for May has not yet been published. This is clearly not enough to cover a deficit of this magnitude.

Oil prices are falling and sanctions are strangling their exports. They are left with two options: end the war to limit spending, or resort to printing money, which will destroy their economy. Some point out that their planned deficit is always 1.5-2 trillion rubles lower than the actual deficit, and this trend has been observed since 2022. With revenues shrinking and military spending growing, they are hurtling toward a financial wall like a locomotive into concrete. This is not just a budget crisis; it is a systemic failure that could transform their economy and the conflict they are fueling. The numbers do not lie, and they scream disaster.

Read more on the Russian economy here.