Russian oil now trading at -40% of what’s required to keep government funded

Russia’s economic stability faces mounting challenges as oil prices plummet to levels far below the government’s budgetary expectations. As of May 2, 2025, the average price for Russia’s Urals and ESPO oil blends has dropped to $48.92 per barrel, or 3,987 roubles, marking a two-year low and standing over 40% beneath the 6,726 roubles per barrel projected in the federal budget.

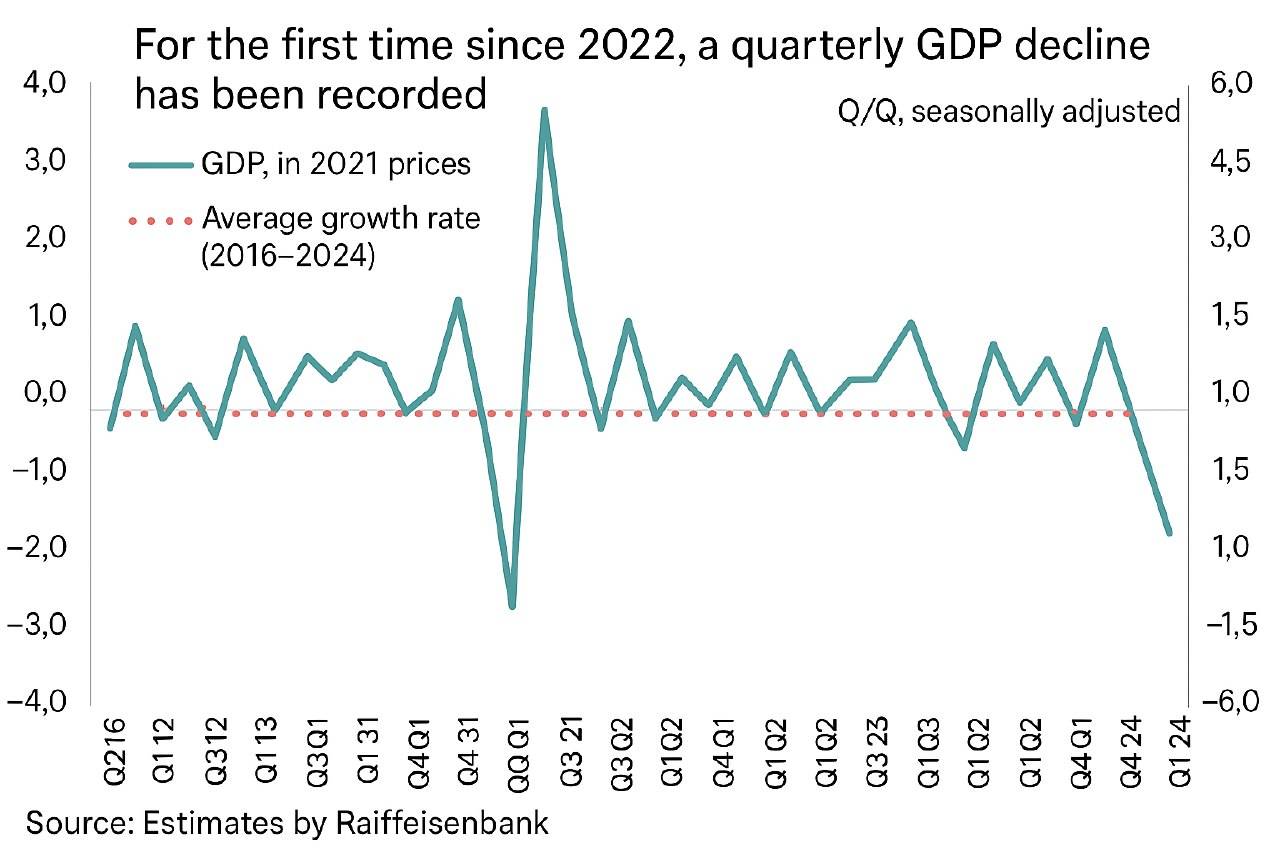

This significant shortfall in oil revenue is exerting considerable pressure on Russia’s fiscal health. Energy revenues, which constitute approximately one-third of the federal budget, are now expected to decline by 24% in 2025. Consequently, the government has revised its budget deficit forecast from 0.5% to 1.7% of GDP.

This significant shortfall in oil revenue is exerting considerable pressure on Russia’s fiscal health. Energy revenues, which constitute approximately one-third of the federal budget, are now expected to decline by 24% in 2025. Consequently, the government has revised its budget deficit forecast from 0.5% to 1.7% of GDP.Several factors contribute to this downturn. Global oversupply concerns, particularly due to increased production by OPEC+ members, have led to falling oil prices. Additionally, fears of a global economic slowdown, exacerbated by recent U.S. trade developments, have dampened demand.

The Kremlin’s financial strategies are further complicated by a strengthening rouble, which has appreciated 38% this year. While a stronger currency can indicate economic resilience, it also reduces the value of converted energy export earnings, thereby expanding the budget deficit.

In response to these fiscal challenges, the Russian government is considering several measures. Finance Minister Anton Siluanov has emphasized the need to bolster the country’s fiscal reserves to ensure at least three years of stable budget financing amid prolonged low oil prices and global economic uncertainty. Proposals include revising the current budget rule that dictates oil revenues above a $60 per barrel ‘cut-off’ are diverted to the National Wealth Fund (NWF). The liquid assets in the NWF, now at $39 billion—down from $112.7 billion before the Ukraine conflict—are critical to covering budget deficits but are dwindling.

Despite these efforts, the outlook remains uncertain. The Ministry of Economy has revised its 2025 forecast for Brent crude oil, reducing the projected average price by nearly 17% to $68 per barrel, compared to a previous estimate of $81.7. The forecast for Urals crude, Russia’s primary oil blend, is also lowered to $56 per barrel, significantly under the $69.7 estimate used in the country’s 2025 budget.

As Russia navigates these economic headwinds, the government’s ability to adapt its fiscal policies will be crucial in maintaining financial stability amid ongoing global market volatility.